The 3-Minute Rule for Heritage Reverse Mortgage Specialists Financial Security in

How to Compare & Find a Reverse Mortgage Lender - MoneyGeek.com

Not known Factual Statements About Nevada Reverse Mortgage - Information & NV Lenders at

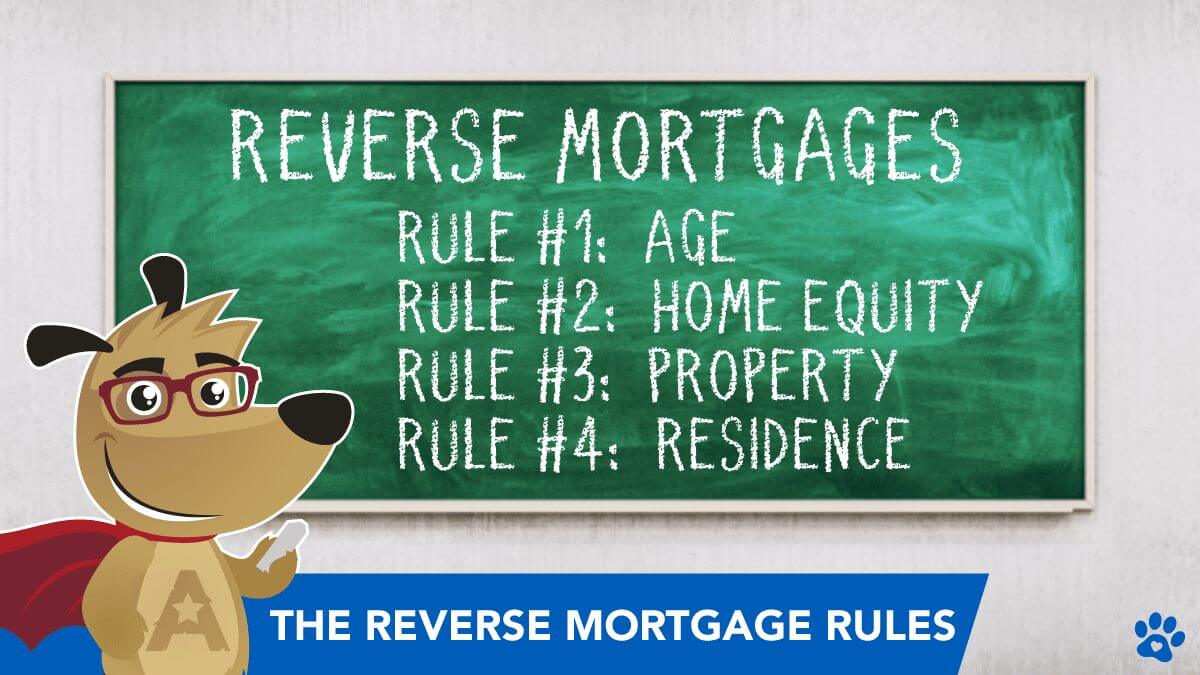

As a general guideline, the older you are and the higher your equity, the larger the reverse home mortgage benefit will be (approximately specific limits, sometimes). The reverse home loan should pay off any outstanding liens versus your home before you can withdraw additional funds. The loan is not due and payable till the borrower no longer occupies the house as a principal house (i.

Reverse Mortgage Counseling - Cambridge Credit

the debtor sells, moves out permanently or passes away). At that time, the balance of obtained funds is due and payable, all additional equity in the home comes from the owners or their beneficiaries. There are three reverse mortgage items readily available, the FHA - HECM (House Equity Conversion Mortgage), Fannie Mae - House, Keeper, and the Money Account programs.

The Best Reverse Mortgage Lenders of 2021

Little Known Facts About Reverse Mortgages: New Rules Make Them Safer for.

The costs related to getting a reverse home loan are similar to those with a conventional home mortgage, such as the origination charge, appraisal and inspection charges, title policy, home mortgage insurance and other typical closing expenses. With Also Found Here , all of these costs will be funded as part of the home mortgage prior to your withdrawal of additional funds.

The counselor's task is to inform you about all of your home mortgage choices. This counseling session is at no charge to the customer and can be carried out in individual or, more typically, over the telephone. After completing this therapy, you will get a Therapy Certificate in the mail which must be included as part of the reverse home mortgage application.

3 Simple Techniques For Reverse Mortgage Loans by Cornerstone Equity Group, Incof

The most popular choice, picked by more than 60 percent of borrowers, is the line of credit, which permits you to draw on the loan proceeds at any time. If a senior house owner chooses to pay back any part of the interest accruing against his borrowed funds, the payment of this interest might be deductible (simply as any home mortgage interest may be).

And, sometimes, the lender increases the total quantity of the line of credit with time (unlike a traditional House Equity Line whose credit limitation is established at origination). If a senior house owner remains in the residential or commercial property till she or he dies, his/her estate valuation will be minimized by the amount of the debt.